44+ is yearly property tax included in mortgage

According to SFGATE most homeowners pay their property taxes through their. Lock In Your Rate With Award-Winning Quicken Loans.

10406 Yale Rd Deerfield Oh 44411 Realtor Com

Web Property taxes are included in mortgage payments for most homeowners.

. Web All you have to do is take your homes assessed value and multiply it by the tax rate. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web How much you pay in taxes depends on your homes value and your governments tax rate.

Web Lets say Jim and Pam decide to buy a home and their mortgage lender estimates theyll owe 1600 in property taxes each year. If you qualify for. If your county tax rate is 1 your.

If your county tax rate. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Learn more about your property taxes and your mortgage.

There are two primary. Web In most cases if youâre a first-time homebuyer your lender is going to require that you pay your property taxes through your mortgage. Instead of letting Jim and Pam.

Web If the assessed value of your home is 200000 your annual tax bill would be 21 times 200 or 4200 or 350 per month. Web Property taxes may be included in your mortgage payment or you may choose to pay them separately. Ad More Veterans Than Ever are Buying with 0 Down.

Web To illustrate lets say your annual property taxes. Ad Compare Home Financing Options Online Get Quotes. This should answer your question are.

Web For example if your lender estimates youll pay 2500 in property taxes in a year and you make your mortgage payments monthly your lender will collect an extra. Web 44 are property taxes included in fha mortgage Jumat 24 Februari 2023 With a Low Down Payment Option You Could Buy Your Own Home. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Web The property tax is usually included in the mortgage payments together with the homeowners insurance interest and principal. Estimate Your Monthly Payment Today. Lets say your home has an assessed value of 100000.

Save Real Money Today. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The mortgage the homebuyer pays one.

Money Hack Check Local Listings Property. Having your property tax. Web When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web ASSESSED VALUE x PROPERTY TAX RATE PROPERTY TAX Lets say your home has an assessed value of 100000. Web Web Property taxes may be included in your mortgage payment or you may choose to pay them separately.

Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. If your home is worth 250000 and your tax rate is 1 your.

Property Taxes In Europe Real Estate Market Prices Purchase And Maintenance Cost Of A House

Property Taxes In Germany 2022 German Properties

Are Property Taxes Included In Mortgage Payments Sofi

Creating A Student Loan Assistance Policy In Any Organization Burr Consulting Llc

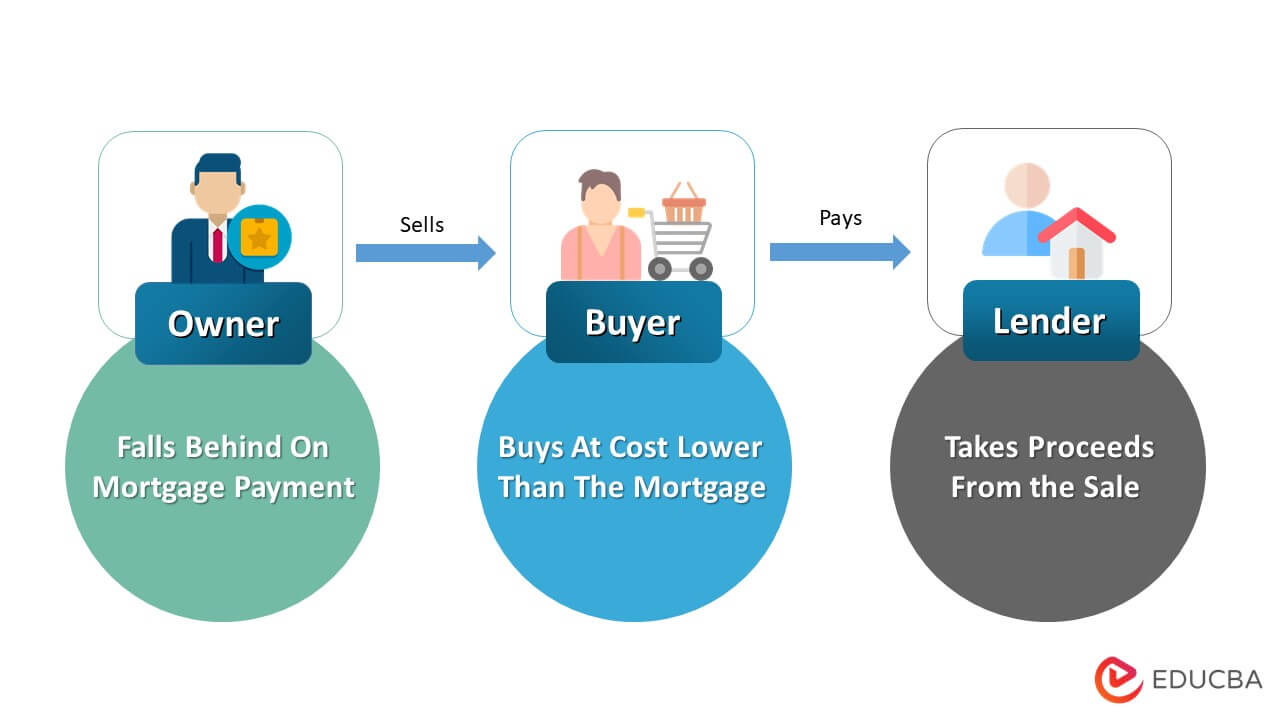

Short Sale In Real Estate Meaning Process Strategies

Property Taxes In Europe Real Estate Market Prices Purchase And Maintenance Cost Of A House

Best To Pay Property Taxes Directly Or With Monthly Mortgage Payments

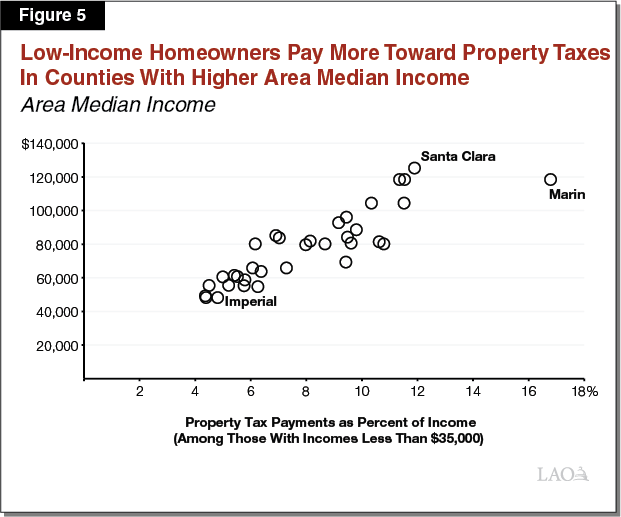

Evaluation Of The Property Tax Postponement Program

Non Recourse Loan How To Obtain A Non Recourse Loan With Examples

Everything You Need To Know About Property Taxes In Germany

Home Affordability Calculator For Excel

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Property Taxes In Europe Real Estate Market Prices Purchase And Maintenance Cost Of A House

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

A Guide To Underwriting Multifamily Property Tax Tactica Real Estate Solutions

Evaluation Of The Property Tax Postponement Program

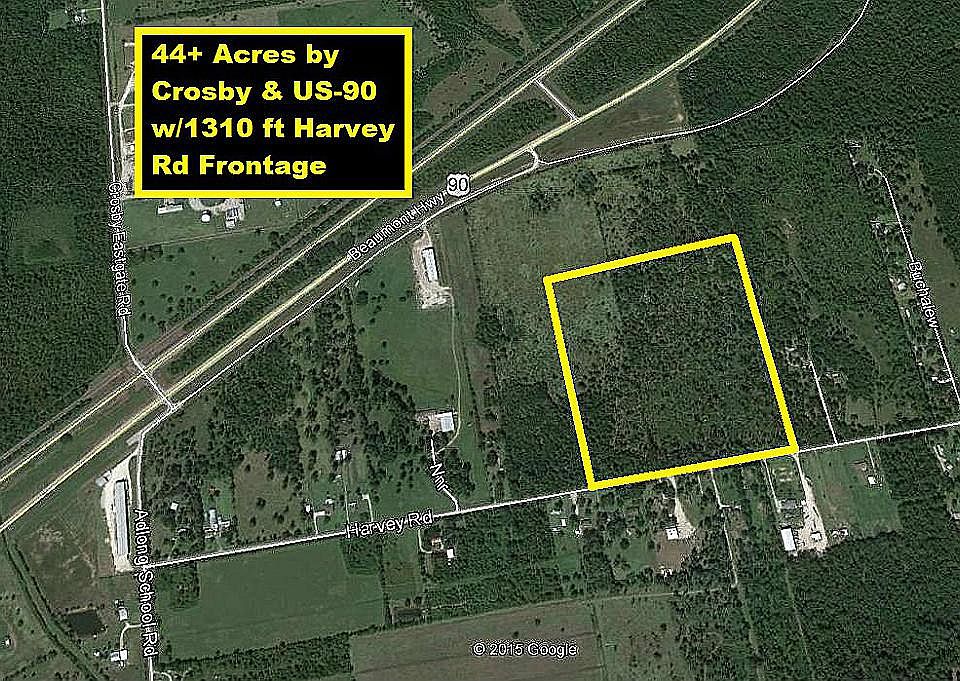

0 Harvey Rd Crosby Tx 77532 Zillow